Smart phones are the obvious mainstay in this category, and are of course used for much more than simple voice communications. There are ‘religious debates’ in automotive and related industries about where consumers and businesses are headed in terms of service in and to vehicles. Services via smartphone apps that use location-based data are usually free to download. Most believe the ability to monetize such services through built-in options and monthly service fees will have less consumer appeal going forward. “Brought in” services, mostly for free (such as the WAZE app, which allows users on the go to note various roadside objects, events, hazards, etc.), should become de rigueur.

Cradle-based Repeaters

A cradle-based repeater will typically have some sort of cradle that functions to mount and secure a mobile handset. The amplifier will typically be mounted out of the way, under a seat, or in the trunk. It will be connected to an external antenna that will be permanently or temporarily mounted to the vehicle exterior. The cradle itself contains passively coupled antennas that pick up the radiated signal transmitted from the handset, boosts it, and sends it to the network via the external antenna. (And vice versa.) These products can be used to boost a single mobile handset.

Smart Signal Boosters

Smart Signal Boosters can capture the exterior cellular signal, ‘clean’ the signal by eliminating noise, and then boost the signal into the interior of the vehicle. They have been endorsed by the FCC as “a cost-effective means of improving our nation’s wireless infrastructure.” One of the key benefits of the Smart Signal Booster architecture is that all devices within range (approximately 20 m2) will benefit. There are no requirements for each device to be connected to an antenna, or otherwise modified. A Smart Signal Booster simply brings the external signal in, and boosts it.

Gain

Gain is one of the most important differentiators when considering Smart Signal Boosters and Repeaters. The gain of an amplifier is the ratio of the power of the outputted signal to the input signal. Amplifiers take a signal, add energy to it, and the output is always greater than the input. When talking about boosters (or amplifiers), gain will be listed in the specification, and it will be reported in decibels (dB). All else being equal, an amplifier with a higher gain will be more powerful than an amplifier with a lower gain. A good way to assess various boosters is “cost per decibel of gain.” Take the purchase price for the unit and divide it by the amount of gain indicated. Lower numbers are better.

MIMO

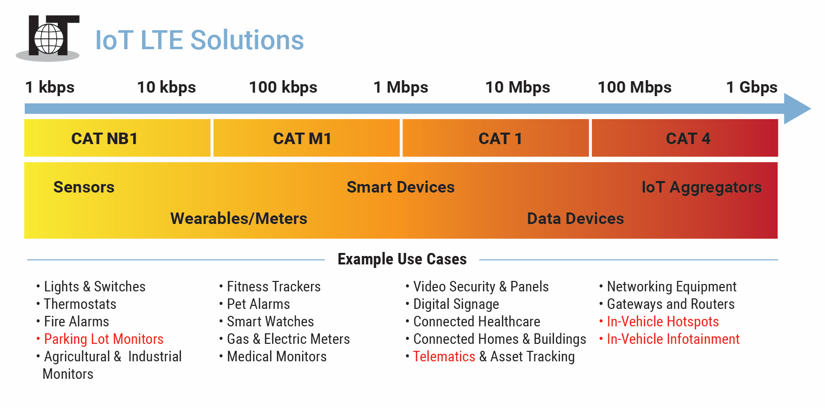

As mentioned above, there are a variety of use cases for mobile wireless technology in vehicles. In applications where high-speed data is beneficial, for example mobile video, using system products that support MIMO is key. MIMO stands for “multiple in multiple out” and is a wireless technology that uses multiple transmitters and receivers to transfer more data at the same time. 4G LTE supports MIMO and can provide data rates at 100 Mb per second, and beyond.

A Note about Regulatory Compliance

There can be wide variation in the sorts of technologies and specific power values allowed across different regions. In the USA, there are effectively three classes of boosters regulated by the FCC:

Keeping people connected through the world’s smartest cell phone signal boosters, public safety communication systems, private networking solutions, and HPUE devices. Powered by proprietary IntelliBoost® technology.

16550 West Bernardo Drive

Building 5, Suite 550

San Diego, CA 92127

+1 (858) 485-9442

[email protected]

©2024 Nextivity, Inc.