April 17, 2024

9:00 AM PDT

45 Minutes

VP Sales for Americas at Nextivity

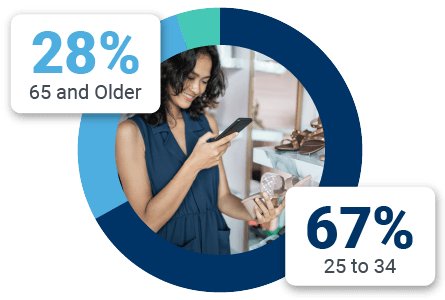

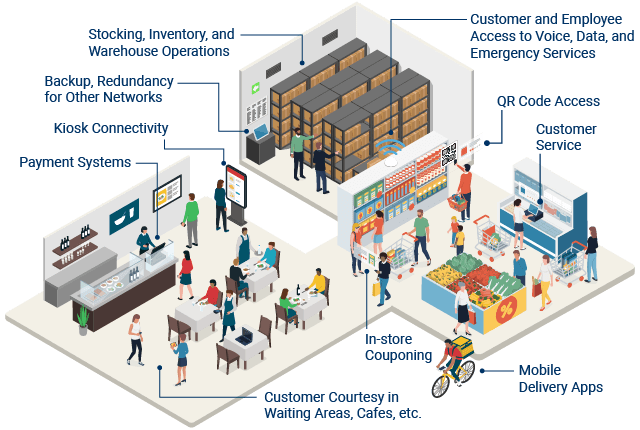

The numbers don’t lie: connected shoppers spend more. To learn how to boost your business through reliable in-building cellular connectivity, Nextivity invites you to join us for an insightful webinar where we delve into the critical role of dependable cellular coverage in retail operations. In today’s fast-paced retail environment, seamless connectivity is a cornerstone for success, impacting customer experiences, operational efficiency, and overall business outcomes.

Combining unmatched performance with ease of installation, CEL-FI GO G43 provides “small box” stores, quick-serve restaurants, and branch offices a fast way to improve cellular connectivity for customers, employees, and operations. The system solves in-building coverage challenges for up to three mobile network operator (MNO) signals.

Most retailers have Wi-Fi. Their first question to us is “why would I spend more money [on cellular sevice]?”.

Here’s why:

You can learn more about the benefits of cellular over Wi-Fi in our upcoming webinar. Click here to register.

The shopping mall solved cellular coverage challenges in its underground food court, enabling guests to take full advantage of their mobile devices during their visit.

Nextivity engineers our solutions from the ground up to ensure your project is hassle-free. From spec to design to installation and maintenance, we’ve thought of everything. Our customers are amazed how quickly we are in and out.

If you are a Nextivity Partner, please log into the Partner Portal for assistance or use this form if you are not able to log into the portal.

Keeping people connected through the world’s smartest cell phone signal boosters, public safety communication systems, private networking solutions, and HPUE devices. Powered by proprietary IntelliBoost® technology.

16550 West Bernardo Drive

Building 5, Suite 550

San Diego, CA 92127

+1 (858) 485-9442

[email protected]

©2024 Nextivity, Inc.